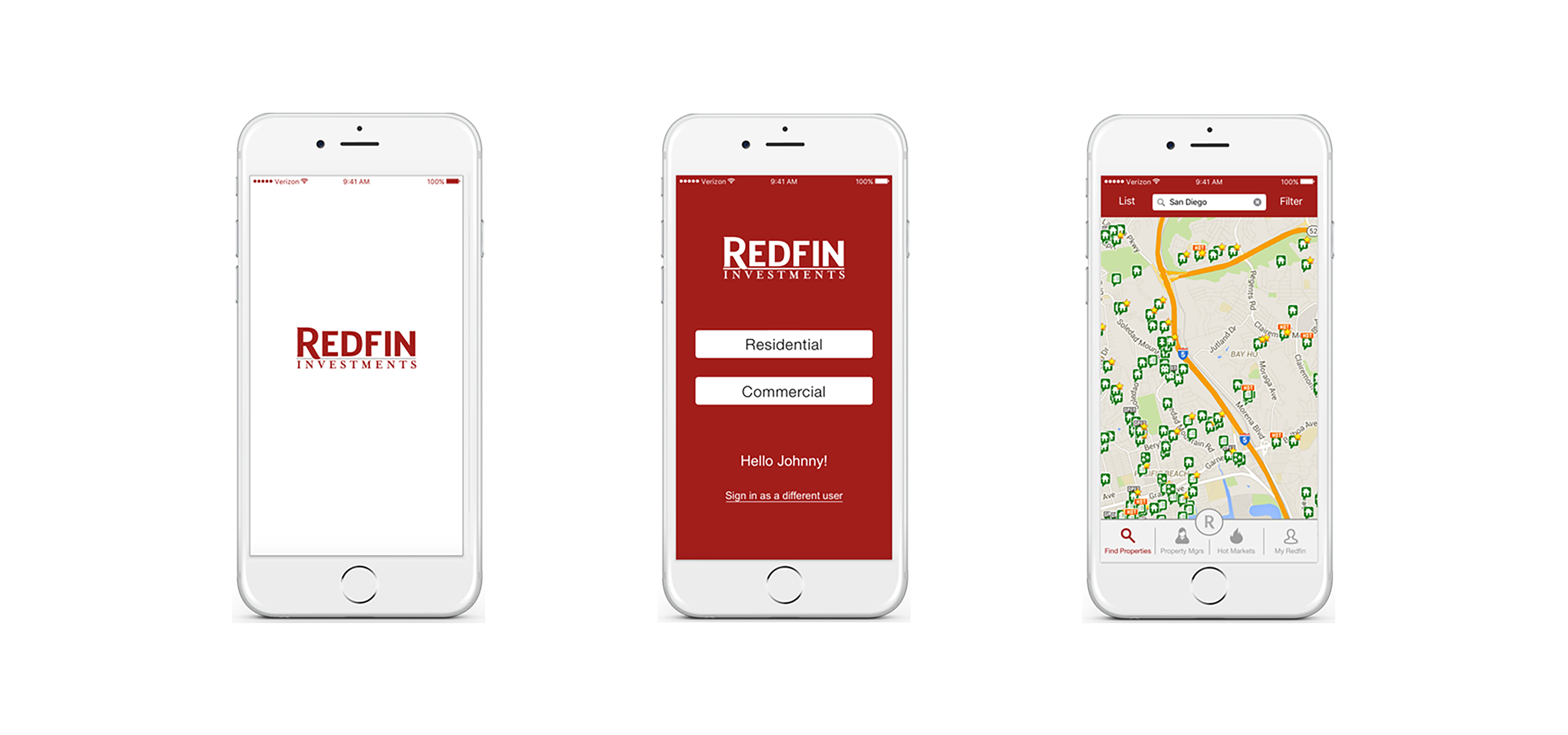

OVERVIEW

Redfin has become a trusted and valuable tool for homebuyers searching for their dream home. However, they do not have a section that caters to real estate investors. Investors need a different set of data than homebuyers, and they also need to be able to verify the state of a property without seeing it in person. No tool currently exists that gives investors all the information they need in one place - and some of the data they need isn't available at all.

My Role: UX/UI Designer, Prototype Lead

Tools: Sketch, Photoshop, Marvel, POP.app

Platforms: Mobile

Deliverables: Interactive Prototype

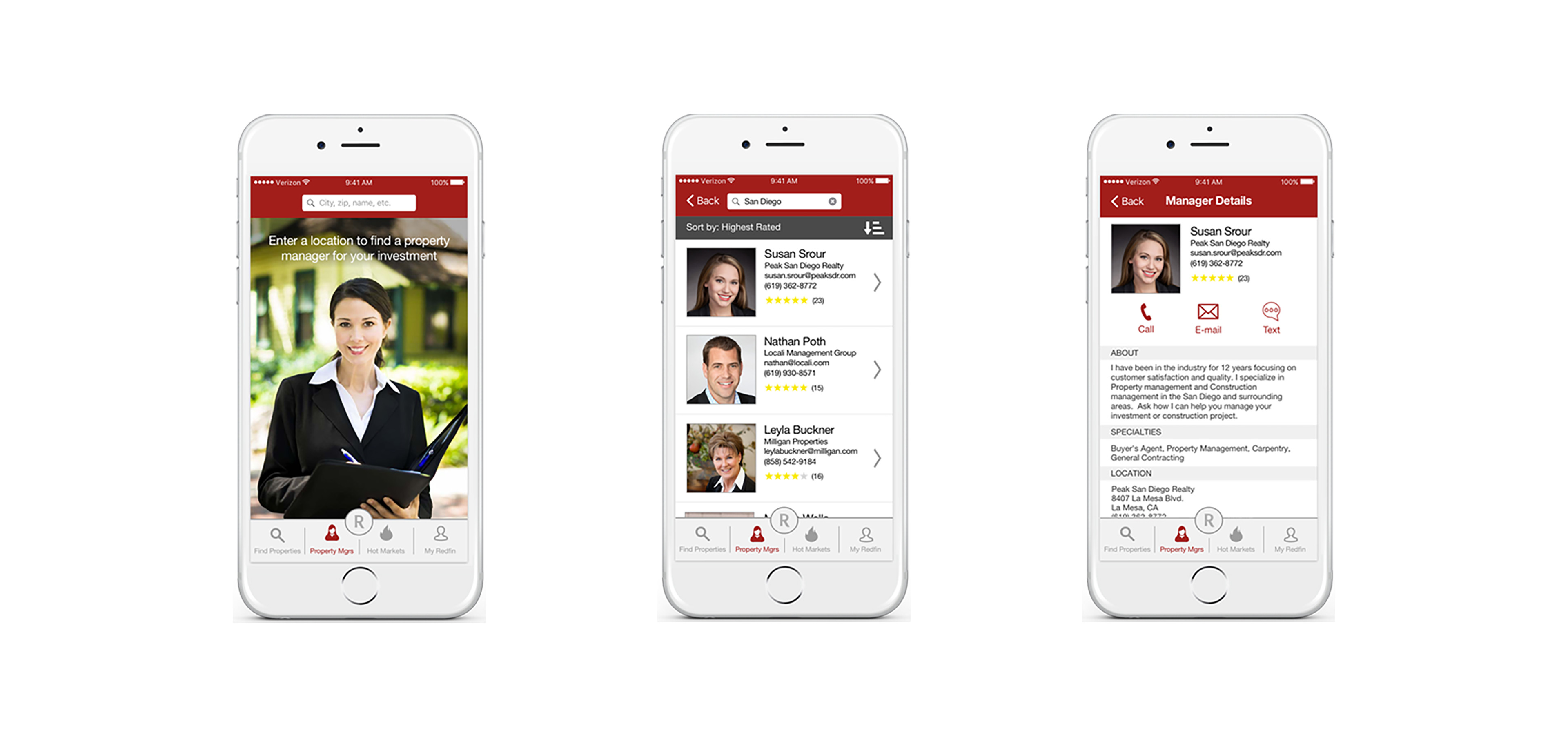

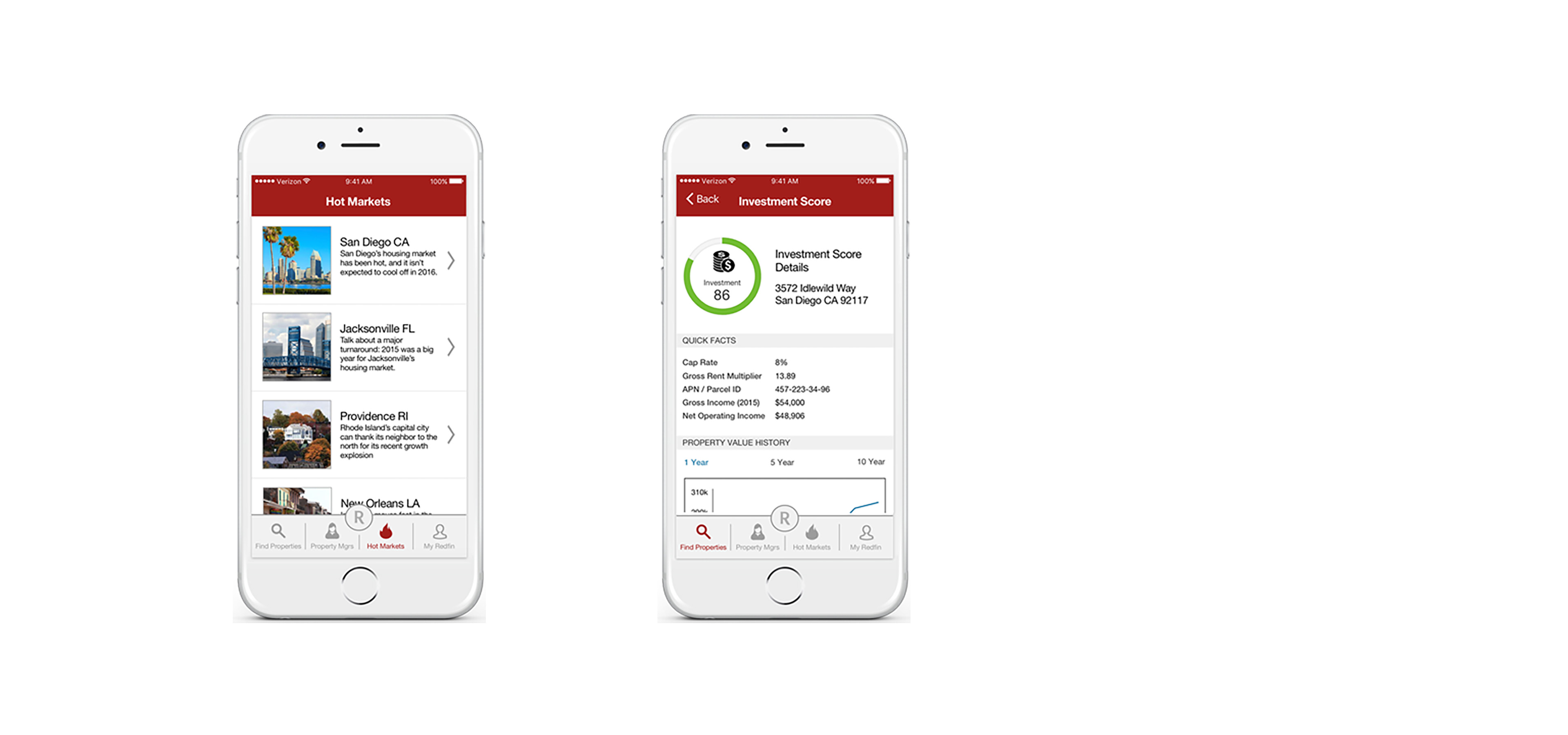

HIGH FIDELITY SCREENSHOTS

RESEARCH

USER INTERVIEWS

My team and I started our research by interviewing several real estate investors.

Key Points:

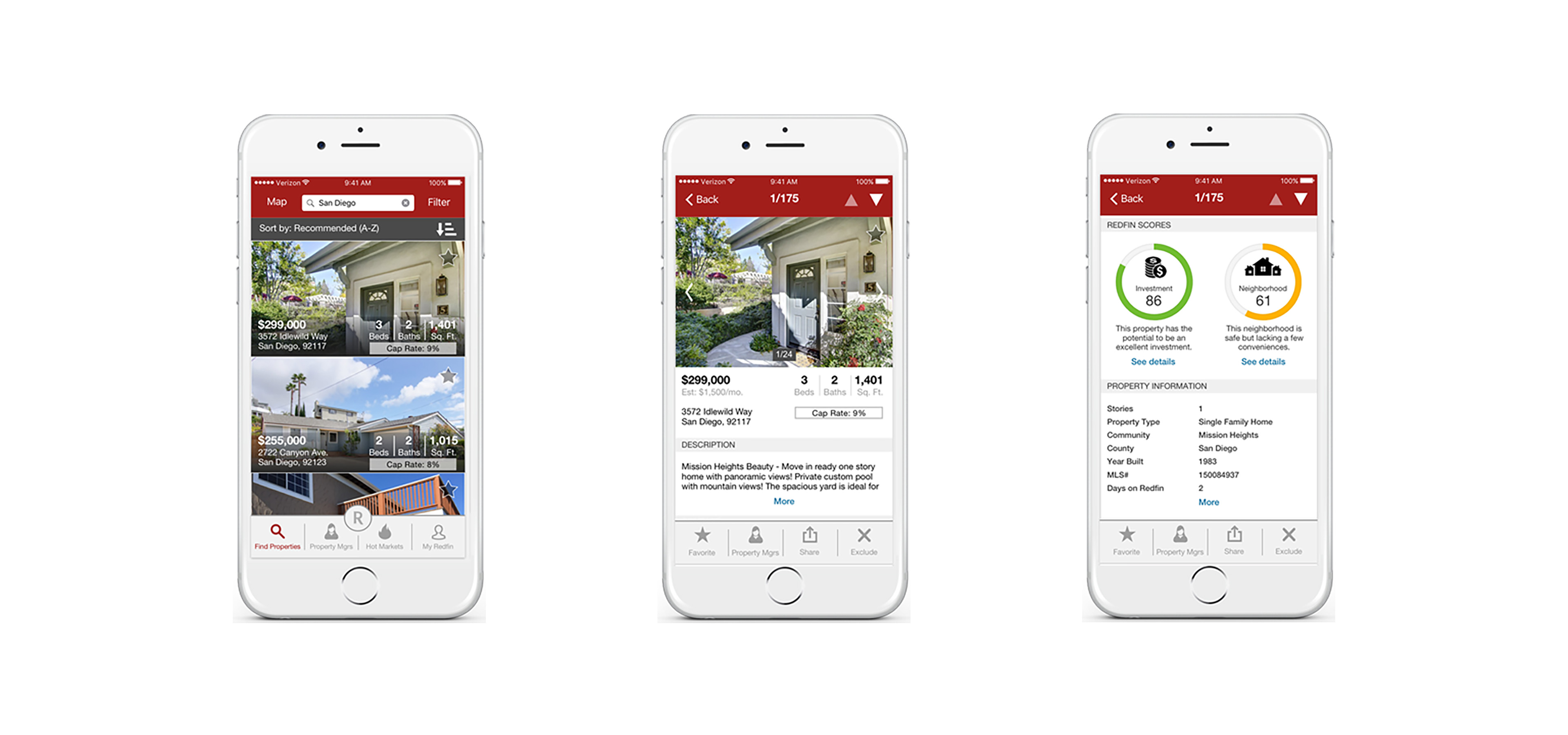

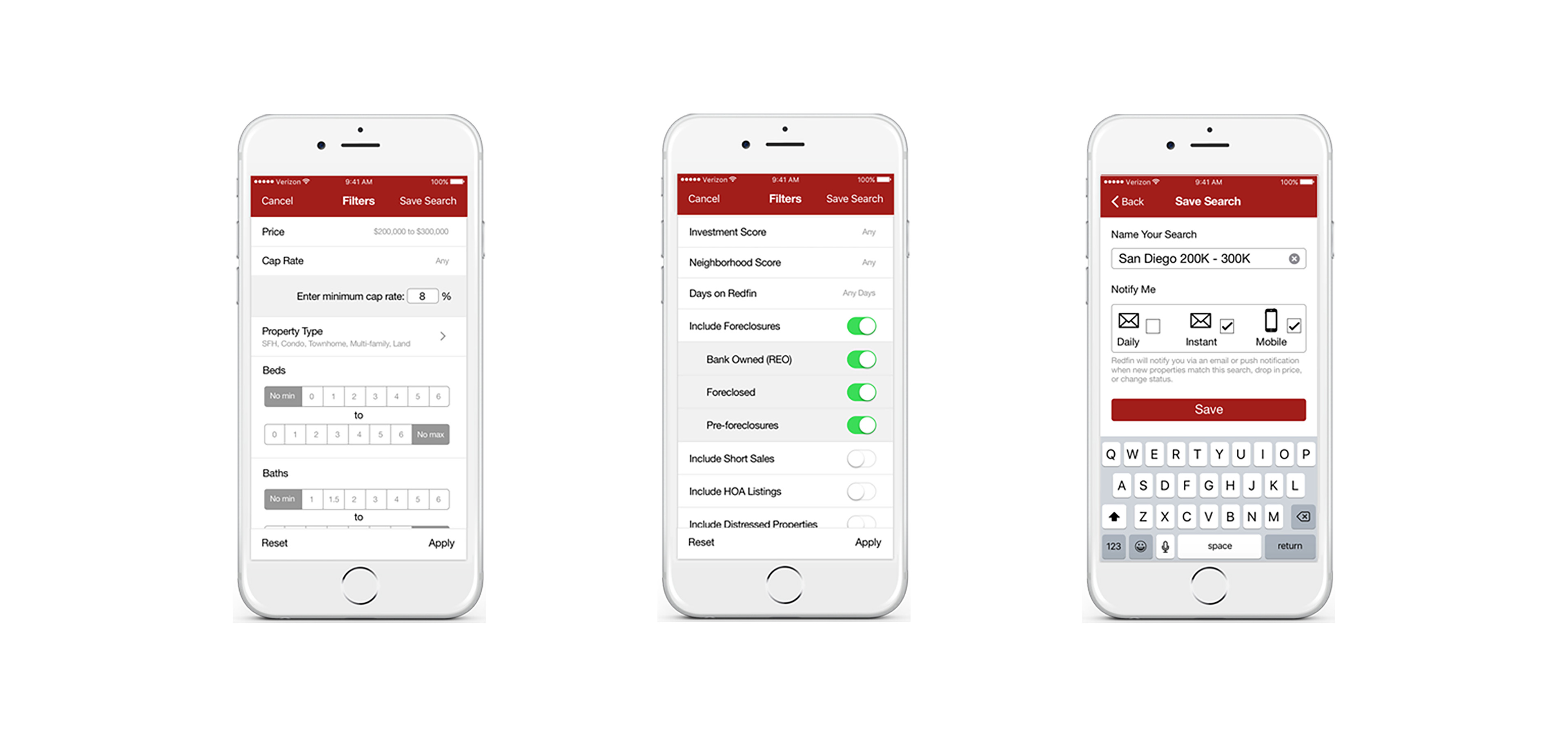

The data that investors need to conduct their research is often not available or scattered across different locations.

The most important number to an investor is the cap rate - it tells how profitable an investment will be.

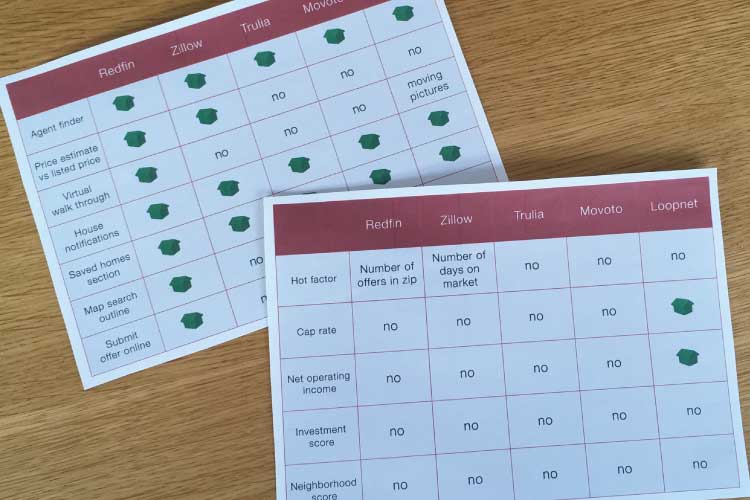

C&C ANALYSIS

A quick C&C Analysis confirmed our findings. Whereas homebuyers have lots of great tools to use - Redfin in particular - resources are scarce on the investing side.

Key Points:

- Loopnet is the only site that caters to investors and shows things like the cap rate and net operating income - but they are missing a lot of other necessary data.

- From a homebuyer's point of view, Redfin is very comprehensive - but they have no investment-related data.

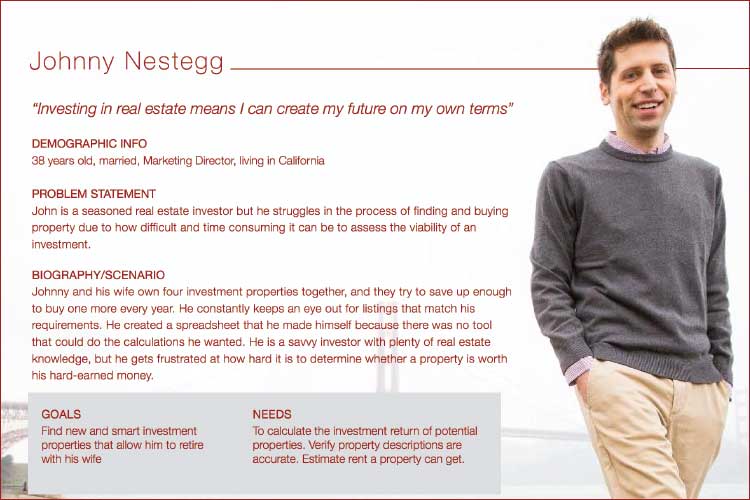

USER PERSONA

Our user persona, based on interviews: "Johnny Nestegg".

Key Points:

- Johnny uses real estate investing as a retirement plan for him and his wife, so his future literally depends on getting the right information.

- Johnny has a good job but isn't necessarily rich - he and his wife try to save up enough to buy one property per year.

LEARNING ABOUT REAL ESTATE

So what exactly do investors need? My team and I dove in and learned all about investment real estate so we could make our users happy.

Key Points:

- The cap rate, simply, is how much money a property makes versus how much it's worth. 8% is considered good.

- Operating expenses for a property include insurance, property taxes, and utilities, among other things - these are numbers an investor needs.

DESIGN

USER TESTING

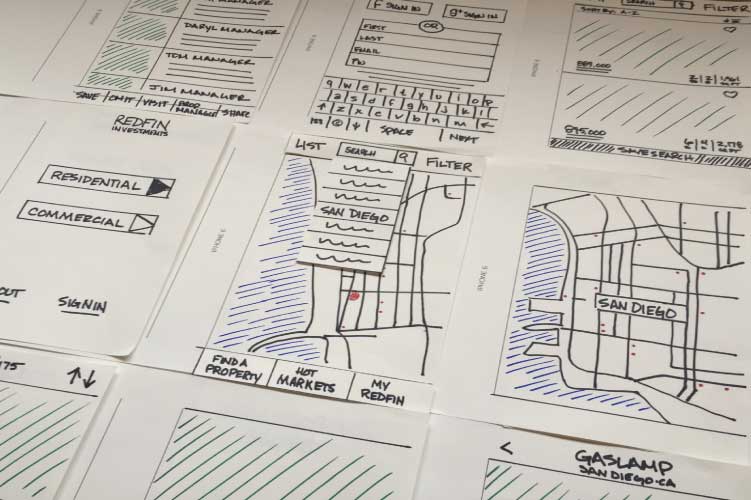

We used POP to do some initial prototype testing and contextual inquiries. Initial feedback was very positive, with a few caveats.

Key Points:

- Testers easily figured out how to search for a property.

- There was no way to switch between "commercial" and "residential".

- Investors wanted property manager information to be in a separate section - so they could find a property manager without looking for a property.

INTERACTIVE PROTOTYPE

With our feedback in hand we designed a clickable prototype of the app to do further testing and finalize the design.

So far, our prototype has received extremely positive feedback from investors. One feature that needs further A/B testing is the page-specific navigation on the property listing page. Some users like it, while some would prefer the navigation to be consistent.

Our next steps will be to create a responsive site that investors can use along with the mobile app.

© 2018 Christina Scanlon. All Rights Reserved.